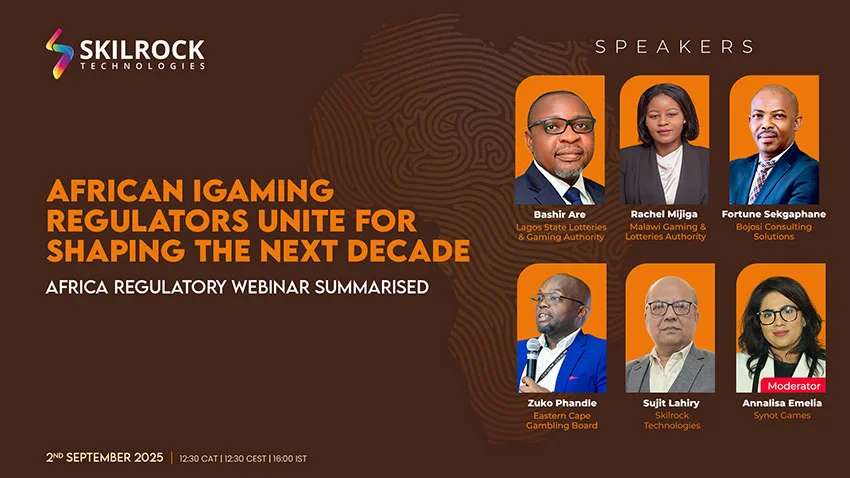

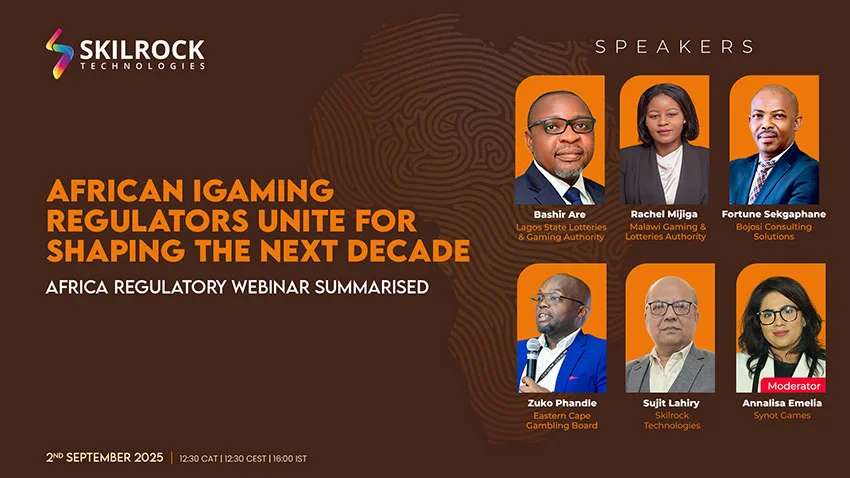

African iGaming Regulators Unite for Shaping the Next Decade: Africa Regulatory Webinar Summarised

Disclaimer: The facts, figures, and projections shared in this blog are based on insights and statements made by panelists during the webinar. They may not represent independently verified data.Africa's gaming industry is entering a defining decade, with 2025 marking a period of rapid regulatory change and digital transformation. To unpack these shifts, we recently hosted a webinar on Africa's Regulatory Landscape 2025: Changes That Matter, bringing together leading regulators and industry experts. The discussion shed light on how reforms are reshaping markets, need for harmonization and standardization, and the opportunities and risks that lie ahead. What follows is a summary of the key insights and takeaways from that engaging conversation.

The webinar featured a distinguished panel of speakers, including:

- Bashir Are, CEO, Lagos State Lotteries & Gaming Authority

- Rachel Mijiga, Director General, Malawi Gaming & Lotteries Authority

- Zuko Phandle, Manager - Audit & Compliance, Eastern Cape Gambling Board (ECGB)

- Fortune Sekgaphane, Director & Lead Consultant, Bojosi Consulting Solutions

- Sujit Lahiry, Executive Director & CEO, Skilrock Technologies

- Annalisa Emelia, Sales & Account Manager - Africa, Synot Games (Moderator)

Click here for full Webinar!

Which regulatory reforms are moving the needle and which markets are setting the benchmarks in modernization?

One of the strongest highlighting messages from the discussion was the impact of COVID-19 pandemic and the rise of mobile internet that forced regulators across Africa to move beyond the existing but outdated legal frameworks and embrace digitalization. Markets that acted quickly are now enjoying the benefits of increased revenues, stronger oversight, and more sustainable growth.

Malawi underwent a major transformation in the gaming industry after COVID-19, with the 1996 Act being repealed and replaced with a new law in 2022 that incorporated internet gaming and licensing for digital operators. Both operators and regulators digitized their systems, with regulators introducing a central monitoring system to track revenues and player accounts. This shift necessitated and ensured not only revenue assurance but also reinforced player protection and responsible gaming practices. The market saw a rapid growth with revenues reaching $73 million in 2024, with projections to grow by 46% to $106 million in 2025. This modernization created responsibilities around balancing stakeholder interests and protecting players and brought growth for operators, government and regulators, alike. Looking ahead, Africa's population growth is expected to increase by 78% by 2050 which presents a huge opportunity for digital gaming, but only if digitization is embraced at every level.

Similar moves are underway across the continent with increased internet access accelerating gaming's shift online and opening the door to online operators, prompting many jurisdictions to update their laws. Supported by this, virtual gaming, live casinos, and sports betting have flourished. Countries like South Africa, Nigeria, and Kenya emerged as key hubs, with online traffic and operator activity concentrated in these markets. However, despite having strong technical standards, a lack of decisive legislative action has slowed progress, leaving gaps that have fueled illegal online activity and reduced fiscal benefits during the pandemic. The absence of comprehensive regulation also left room for illegal operators to exploit the market, highlighting the urgent need for updated laws across jurisdictions. Success stories such as Betking in Nigeria, which launched in 2018 and quickly rose to become a leading operator, showcase how internet-driven innovation is reshaping Africa's gaming industry and attracting global operators back to the region.

South Africa in specific illustrated both the opportunities and risks of this lag by not legalizing interactive online gambling, leaving only sports betting to be permitted online. This gap cost the country significant revenue when the land-based operations shuttered during the pandemic. The pandemic, however, forced companies, regulators, and governments to adopt digital solutions, accelerating digitization across the industry, a shift that is still evident today in virtual meetings and online operations. Historically, sports betting has been among the most innovative sectors, introducing new platforms, events, and operational methods, including wage and record-keeping systems. Against this backdrop, it is clear that the adoption of digital technologies was largely driven by necessity during COVID-19. However, South Africa's legislative framework lagged, leaving regulators struggling to protect the public, manage problem gambling, and combat illegal online gambling. It now makes up a significant portion of the market. In contrast, countries like Kenya and Malawi modernized their frameworks which allowed them to license online operators, strengthening their fiscal base. The delay in updating South Africa's regulatory framework continues to carry substantial economic and social costs. This pattern is not unique to South Africa but the pandemic forced both regulators and operators to accelerate digitization, but inconsistent legal frameworks remain a barrier across the continent.

The gaming industry in Africa is undergoing a major transition, where the push for innovation is colliding with regulatory and socioeconomic realities. While several countries such as Kenya, Zambia, and Rwanda worked on updating their laws to address online gambling, the pandemic revealed how unprepared most regulators were for rapid digital adoption. South Africa, for example, already had provisions and technical standards but failed to act quickly enough, missing the chance to formalize online gambling. Hence, the broader challenge that African countries face is that while they have an attractive legislation on paper, they lack the institutional structures, technical standards, and resources to enforce it effectively. This gap can lead to serious consequences. Without proper oversight, illegal operators thrive, gambling addiction continues to grow and unmonitored financial flows open the gates for money laundering, fraud and even terrorism financing which are threats that can destabilize economies and compromise the security of a nation. A recent case in Zimbabwe highlights how economic pressure combined with weak regulation has created a “perfect storm” in online betting, underscoring that legislation alone is insufficient. The real need lies in building strong regulatory institutions, updating standards in line with technology, and ensuring resources are in place to balance the economic benefits of gaming with the social and security risks it brings.

Globally, the growth of online and mobile gaming has been rapid, and Africa is seeing unmatched growth in mobile gaming adoption in recent years. This transition has created both opportunities for revenue generation and new challenges around oversight. While monitoring online activity is often more feasible than controlling street-level or land-based gambling, a holistic approach is needed that considers the realities of both. Larger jurisdictions may find it easier to implement solutions, but smaller ones face greater challenges. Nonetheless, there is a growing call for a common minimum framework across Africa that can balance opportunity with responsibility, ensuring that the benefits of modernization are not undermined by social and economic risks.

Is Africa moving toward regulatory harmonization in gaming, and what institutional frameworks or bilateral mechanisms are driving cross-border alignment and communication? What more could be done to strengthen this process, and where is the greatest potential for progress?

The discussion emphasized that collaboration is essential as a foundation for harmonization across African gaming jurisdictions and it is only possible when regulators are willing to understand each other's systems, developmental stages and comparative advantages. If they start adapting best practices from one another, it is highly likely that they can establish fundamental continental standards that simplify operations for regulators, operators, suppliers, payment companies and banks. While minor differences will exist due to varying government structures, collaboration creates a baseline standard that benefits all stakeholders and accelerates progress.

Existing regulatory bodies, such as GRAF are making efforts to mobilize African regulators with a focus on reviving and amplifying these organizations to drive regional alignment. This concept of inclusive representation from regions across Africa on the trustee boards ensures effective decision-making. By emulating global models where leading economies set the pace, Africa can achieve harmonization more efficiently.

While harmonization requires significant financial and infrastructural investments, it allows member states to work coherently without duplicating efforts. Existing frameworks like GLI and EU's central monitoring system can be leveraged, and harmonization also demands connectivity, bandwidth, and willingness from members to contribute to a shared framework. Uniform regulations and clear requirements are crucial for successful implementation.

International technical standards should be adopted by different jurisdictions rather than developing new ones locally, which can take years. Minor modifications needed to suit local legislations can further be made, but the fundamental standards are widely recognized and tested by prominent laboratories like BMM and GLI. Adopting these pre-existing standards significantly shortens implementation time and prevents delays that could allow problems to grow. Since, African jurisdictions share similar contexts, uniform rules and standards are achievable. Manufacturers already rely on these standards when deploying gaming equipment across Africa, demonstrating their practicality. Memoranda of understanding between jurisdictions can formalize cooperation and facilitate cross-border regulatory alignment more efficiently and avoid redundant checks, reducing frustration for operators. Ultimately, some jurisdictions must take the lead to drive harmonization, ensuring that uniform standards are implemented consistently while respecting minor local variations.

Hence, leadership is also critical in driving harmonization and successful bilateral arrangements with other countries and international regulators. By building on these collaborative mechanisms and having leading jurisdictions take the initiative, African regulators can more effectively harmonize standards, facilitate cross-border operations, and strengthen the regulatory environment across the continent.

What are your views on a multi-jurisdictional license in Africa to reduce B2B barriers, speed up market entry, and allow operators to operate across multiple countries efficiently, with technology enabling seamless information sharing?

The discussion began with highlighting the importance of understanding the continent not just as a whole but as a collection of regions, each having its own trade agreements and economic clusters. As discussed earlier during the webinar, while harmonization of regulatory frameworks is a shared goal, it is essential to respect political structures, cultural contexts, and the sovereignty of individual countries. It is also important to understand that political instability in certain regions can also affect how regulatory bodies are structured and how they function, with some organizations existing legally but not operationally. This underscores the importance for functional awareness along with legislative frameworks to ensure the harmonization efforts are realistic as well as effective. GRAF provided a platform for collaboration although there have been attempts to form additional associations that could fragment efforts, however, there has been a push to unify African standards through regional bureaus. It was suggested that GRAF member states should establish working groups to operationalize decisions made at conferences, as many valuable discussions are often left unimplemented, leading to repeated dialogue on the same issues for decades.

The role of government in creating a conducive environment for the industry to thrive responsibly is also necessary. There is a need for the governments to establish policies that guide regulators while understanding the broader economic and social implications, including revenue collection and public protection. And regulators must balance promoting growth with ethical oversight, leveraging digital technologies to manage responsible gambling, detect illegal activity, and ensure compliance. Harmonization does not require standardization of every aspect; countries can agree on fundamental principles while accounting for differences in legal systems.

When reflecting on the gambling regulatory framework, the discussion pointed to the need for it to be reimagined around core principles such as integrity, the protection of vulnerable groups, and ensuring fairness and accountability on the part of operators. On the technological front, attention should be on the growing importance of data privacy and cybersecurity, regulatory trust and transparency, sustainable revenue that aligns with social responsibility, and the ability to adapt quickly to emerging technological threats.

In addition, coordination among countries should be seen as a practical solution to address operational inefficiencies. Through memoranda of understanding and closer collaboration with international counterparts, regulators can share verification processes and streamline licensing, reducing unnecessary duplication across jurisdictions. While challenges remain, the consensus was that viable solutions already exist and progress can be accelerated if certain African countries take the initiative and set examples that others can follow.

Policy of course is the foundation of effective regulation, driving legislation, regulations, and operational processes. Within countries like South Africa, collaboration among provinces is essential for harmonization, mirroring the broader principle that effective governance and standardization are built on strong policy foundations. Governments providing clear directives hence will enable regulators to protect player interests and manage the industry more efficiently.

But, the role of technology extends beyond game management to facilitating regulatory discussions, knowledge sharing, and collaboration across countries. Digital tools can create repositories of information accessible to regulators, support communication, and reduce the costs of coordination. Technology enables the establishment of common baseline standards while allowing countries to add specific political or cultural considerations. The panel emphasized that technology is not only a tool for regulation but also a platform for improving collaboration, sharing expertise, and strengthening harmonization efforts across Africa in a cost-effective and efficient manner.

How important is standardizing regulator websites and making regulatory information easily accessible across African countries, and what are your closing thoughts on the timeline and direction for achieving meaningful progress?

The discussion concluded with reflections on Africa's significant potential in the global gaming industry. With population expected to double by 2050, and internet penetration continuing to rise, Africa is one of the most promising markets and creates a natural momentum for the industry. This also explains why important international operators are steadily increasing their footprints across African markets, as seen with brands already listed internationally and expanding into multiple African countries. This trend gives birth to expectations for regulators to establish policies and standards that are inviting as well as efficient, ensuring that Africa can not just attract but also retain these large-scale investments, with jurisdictional standardization being the crucial enabler, making it easier for brands to enter, create employment opportunities, contribute to GDP growth, and strengthen industry as a whole. Regulators, however, on the other hand need to carry the responsibility of ensuring that operators balance profitability with consumer protection and sustainable growth, as the long-term viability of the sector depends on safeguarding players.

There was a strong call for collaboration and a shared commitment to push the industry forward,since without coordinated action, illegal operators continue to benefit from regulatory gaps. The panel noted that Africa already had the tools and influence to build sustainable solutions, but this requires regulators and stakeholders to engineer financial and operational strategies that can withstand political and structural challenges. While approval from governments and ministries may be difficult, persistence and collaboration can lead to progress, and meaningful improvements can be expected in the near future.

Another distinguished note was the role of technology as a key driver of the future. As iGaming continues to grow, Africa's diverse consumer base would influence a hybrid model to dominate, enabling the coexistence of both digital and land-based formats. Brick-and-mortar establishments may downsize but will remain relevant due to consumer preferences. But at the same time, emerging technologies such as IoT, big data, and AI will shape the landscape and should be deployed responsibly because consumer protection is a shared responsibility, not only for regulators but also the operators.

Attention was further drawn to the challenges within the existing legislation. In many countries, gambling regulation is fragmented across multiple ministries, such as finance, tourism, and trade, hence creating inefficiencies. Examples from international markets illustrate the need to consolidate responsibilities under a unified framework. Regulators must engage with ministers directly to secure political will, as sustainable reforms require informed leadership at the policy level and the absence of clear policy frameworks in various jurisdictions can lead to constant amendments without a consistent direction, thus slowing progress. A solid foundation is needed including socioeconomic assessments as a part of licensing processes to ensure gambling revenues translate into tangible benefits like employment, education and healthcare.

The discussion concluded with a consensus that harmonization and standardization are achievable and illegal gambling can be addressed using centralized monitoring systems, better data protection and cross-border cooperation to create a unified and stronger industry.

For deeper insights and perspectives from leading regulators, operators, and experts, explore our recent webinar, WATCH HERE! Stay connected for upcoming discussions that will continue shaping the conversation around Africa's gaming future.

English

English

Spanish

Spanish

Portuguese

Portuguese